YTL Hospitality REIT

YTL Hospitality REIT has a market capitalisation of approximately RM 2.04 billion (as at 31 March 2024) and comprises prime hotel and hospitality-related properties. In Malaysia, these include the JW Marriott Hotel Kuala Lumpur, The Ritz-Carlton, Kuala Lumpur, The Residences at The Ritz-Carlton, Kuala Lumpur, the Pangkor Laut, Tanjong Jara and Cameron Highlands resorts and the AC Hotels chain of hotels in Kuala Lumpur, Penang and Kuantan. YTL Hospitality REIT's international portfolio comprises Hilton Niseko Village in Japan and the Sydney Harbour, Brisbane and Melbourne Marriott hotels in Australia.

YTL Hospitality REIT was listed on 16 December 2005 on the Main Market of Bursa Malaysia Securities Berhad under the name Starhill Real Estate Investment Trust, with a principal investment strategy of investing in a diversified portfolio of income-producing real estate, used primarily for retail, office and hospitality purposes, with particular focus on retail and hotel properties. Its portfolio consisted of 2 retail properties, Starhill Gallery and parcels in Lot 10 Shopping Centre, as well as a hotel property, the JW Marriott Hotel Kuala Lumpur. In 2007, the REIT acquired an additional hotel property comprising 60 units of serviced apartments, 4 levels of commercial podium and 2 levels of car parks located within The Residences at The Ritz-Carlton, Kuala Lumpur.

In 2009, the Trust embarked on a rationalisation exercise to reposition itself as a pure play hospitality REIT, focusing on a single class of hotel and hospitality-related assets. The first stage of the repositioning involved the disposal of the REIT's retail portfolio (Starhill Gallery and parcels in Lot 10 Shopping Centre), which was completed in June 2010.

The REIT subsequently acquired 9 additional hotel properties in November and December 2011, namely, the Pangkor Laut, Tanjong Jara and Cameron Highlands resorts, The Ritz-Carlton, Kuala Lumpur, and the remainder of The Residences at The Ritz-Carlton, Kuala Lumpur, the Vistana chain of hotels in Kuala Lumpur, Penang and Kuantan, and Hilton Niseko Village in Japan. The REIT's international portfolio was further enhanced with the acquisitions of the Sydney Harbour, Brisbane and Melbourne Marriott hotels in Australia in November 2013.

On 11 December 2013, the REIT changed its name from Starhill Real Estate Investment Trust to 'YTL Hospitality REIT'.

YTL Hospitality REIT was established by a trust deed entered into on 18 November 2005 (as restated by the deed dated 3 December 2013) between Pintar Projek Sdn Bhd ("Pintar Projek") and Maybank Trustees Berhad, as manager and trustee, respectively, of YTL Hospitality REIT.

Starhill Global REIT

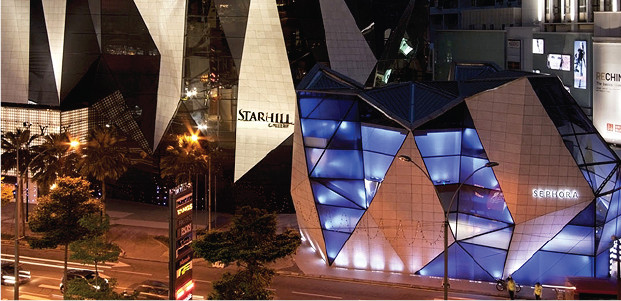

Starhill Global Real Estate Investment Trust (formerly known as Macquarie Prime REIT) was listed on the Singapore Stock Exchange on 20 September 2005. The Singapore-based real estate investment trust had an initial property portfolio comprising stakes in two landmark properties along Singapore's famed Orchard Road shopping belt, namely Ngee Ann City and Wisma Atria. In 2008, Starhill Global REIT acquired seven properties located in the prime areas of Roppongi, Shibuya-ku, Minato-ku and Meguro-ku in Tokyo, and a premier retail property in Chengdu, China.

Most recently, in 2010, Starhill Global REIT acquired Starhill Gallery and parcels in Lot 10 in Kuala Lumpur, Malaysia, and the David Jones Building in Perth, Australia, increasing the trust's portfolio size to approximately S$2.1 billion.